Main Navigation Links

Objectives

The Show Me Your Receipts project is designed to:

(1.) Meet one of the learning objectives of the VCCS (Virginia Community College System) standards for:

MTH 132: Business

Mathematics

(Provides instruction, review, and drill in percentage, cash and trade discounts, mark-up,

payroll, sales, property and other taxes, simple and compound interest, bank discounts, loans,

investments, and annuities).

MTH

133: Mathematics for Health Professions

(Presents in context the arithmetic of fractions and decimals, the metric system and dimensional

analysis, percents, ratio and proportion, linear equations, topics in statistics, topics in

geometry, logarithms, topics in health professions including dosages, dilutions and IV flow rates.).

MTH 154:

Quantitative Reasoning

[Solve real-life problems requiring interpretation and comparison of various representations of

ratios (i.e., fractions, decimals, rates, and percentages including part to part and part to

whole, per capita data, growth and decay via absolute and relative change)].

(2.) Meet the QM (Quality Matters) and USDOE (United States Department of Education) requirements for

distance education as regards the

provision of RSI (Regular and Substantive Interaction).

Federal Register: Distance Education and Innovation

St. John's University: New Federal Requirements for Distance Education: Regular and

Substantive Interaction (RSI)

Student – Content Interaction: Very high

Student – Student Interaction: Flexible

Student – Faculty Interaction: Flexible

(3.) Solve applied problems involving percents.

Example Guides

Case 0: What Item?

SamDom4Peace did not pay a sales tax in one of the items.

Identify the item.

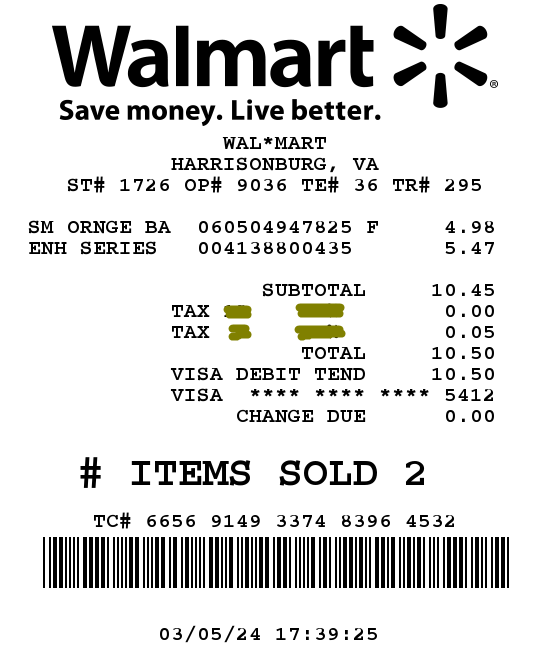

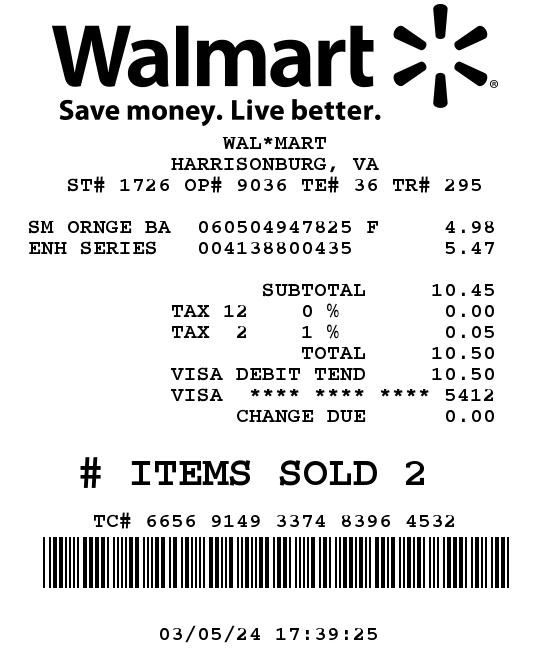

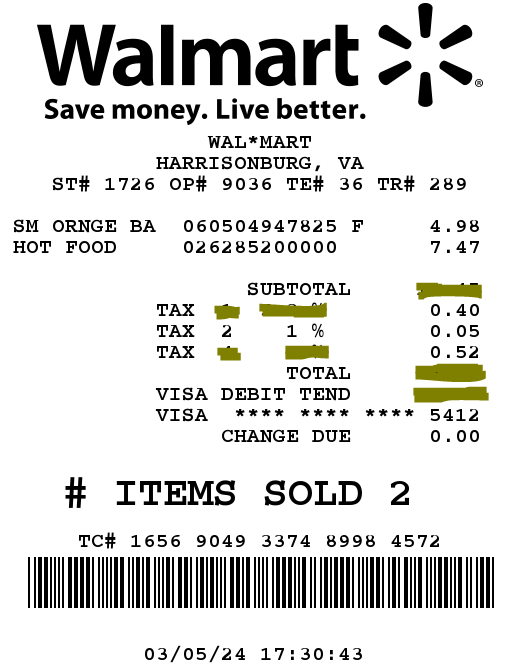

This is the receipt:

Let:

SM ORNGE BA = Item 1

ENH SERIES = Item 1

There are two items but only 1 tax rate of 1%

Let us find the tax amount of 1% tax for each item

$ 1\% = \dfrac{1}{100} = 0.01 \\[5ex] \underline{Item\;1} \\[3ex] Cost = 4.98 \\[3ex] Tax = 0.01(4.98) \\[3ex] = 0.0498 \\[3ex] \approx \$0.05 \\[5ex] \underline{Item\;2} \\[3ex] Cost = 5.47 \\[3ex] Tax = 0.01(5.47) \\[3ex] = 0.0547 \\[3ex] \approx \$0.05 \\[3ex] $ As we can see, the tax amount is approximately the same for both items.

So, how can we figure out the item?

Note the responses of your students.

Advise them accordingly.

Case 1: Given: Initial price and Tax rate

Calculate:

(a.) Tax

(b.) Total price

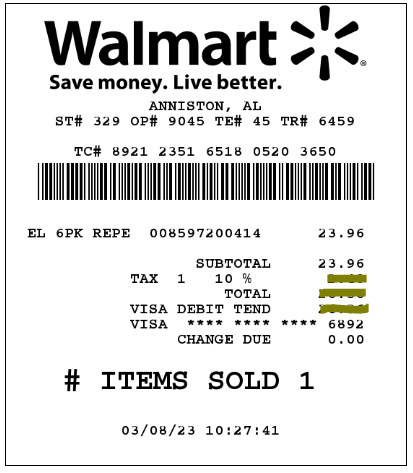

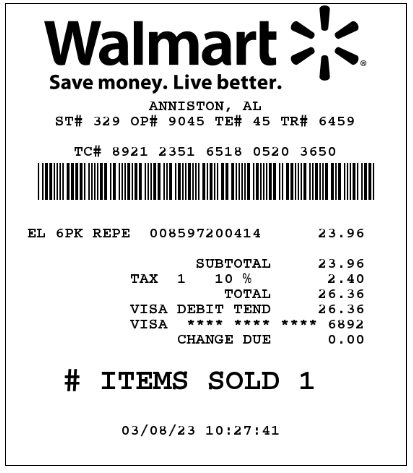

This is the receipt:

Let:

EL 6PK REPE = Item

$ (a.) \\[3ex] 10\% = \dfrac{10}{100} = 0.1 \\[5ex] \underline{Item} \\[3ex] Cost = 23.96 \\[3ex] Tax = 0.1(23.96) \\[3ex] = 2.396 \\[3ex] \approx \$2.40 \\[3ex] (b.) \\[3ex] Total\;\;price = 23.96 + 2.396 \\[3ex] = 26.356 \\[3ex] \approx \$26.36 $

Case 2: Given: Tax rate and Total price

Calculate:

(a.) Initial price (Subtotal)

(b.) Tax

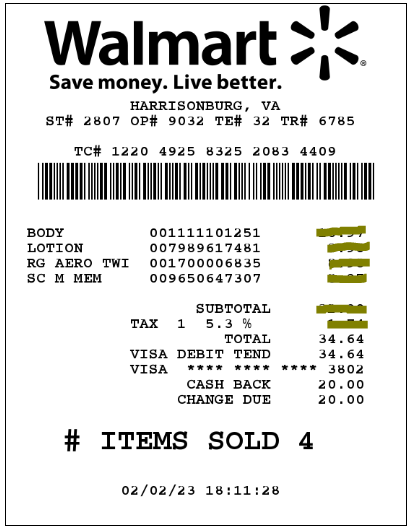

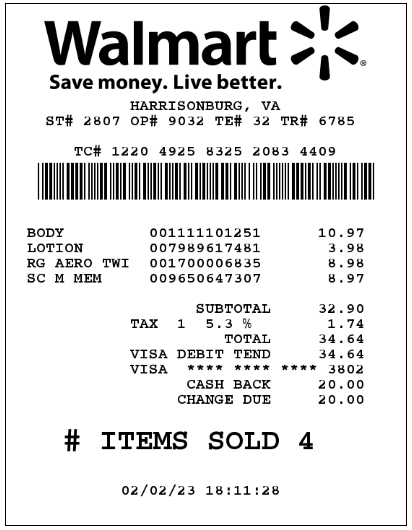

This is the receipt:

Let the subtotal (sum of the initial prices) of the items = p

$ (a.) \\[3ex] 5.3\% = \dfrac{5.3}{100} = 0.053 \\[5ex] \underline{Item} \\[3ex] Subtotal = p \\[3ex] Tax = 0.053(p) = 0.053p \\[3ex] Total\;\;price = p + 0.053p \\[3ex] = 1.053p...Calculated \\[3ex] = 34.64 ...Given \\[3ex] \implies \\[3ex] 1.053p = 34.64 \\[3ex] p = \dfrac{34.64}{1.053} \\[5ex] p = 32.89648623 \\[3ex] Subtotal \approx \$32.90 \\[3ex] (b.) \\[3ex] Tax = 0.053(32.89648623) = 1.74351377 \\[3ex] Tax \approx \$1.74 $

Case 3: Given: Tax rate and Tax (Use $1.29638)

Calculate:

(a.) Initial price (Subtotal)

(b.) Total price

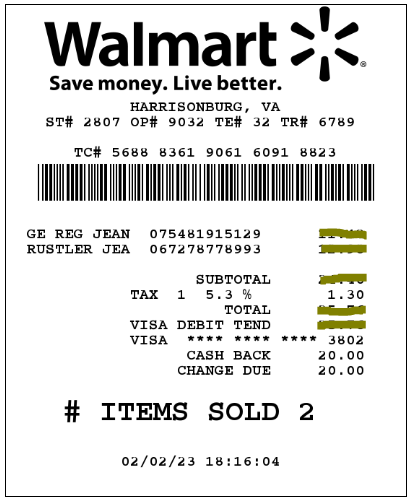

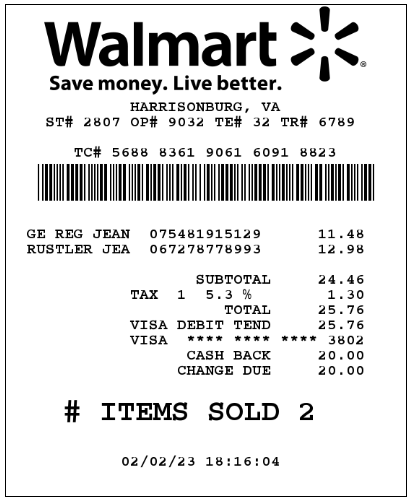

This is the receipt:

Let the subtotal (sum of the initial prices) of the items = p

$ (a.) \\[3ex] 5.3\% = \dfrac{5.3}{100} = 0.053 \\[5ex] \underline{Item} \\[3ex] Subtotal = p \\[3ex] Tax = 0.053(p) = 0.053p...Calculate \\[3ex] Tax = 1.29638 ... Given \\[3ex] \implies \\[3ex] 0.053p = 1.29638 \\[3ex] p = \dfrac{1.29638}{0.053} \\[5ex] p = 24.46 \\[3ex] Subtotal \approx \$24.46 \\[3ex] (b.) \\[3ex] Total\;\;price = 24.46 + 1.29638 \\[3ex] = 25.75638 \\[3ex] \approx \$25.76 $

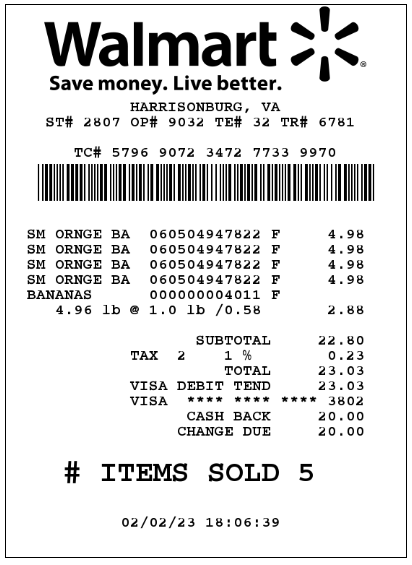

Case 4: Given: Five items, Part of the subtotal (Initial prices of four items),

Tax rate, and Total price

Calculate:

(a.) Subtotal (sum of the initial prices)

(b.) Tax

(c.) Initial price of the fifth item

(d.) Unit price of the fifth item per pound

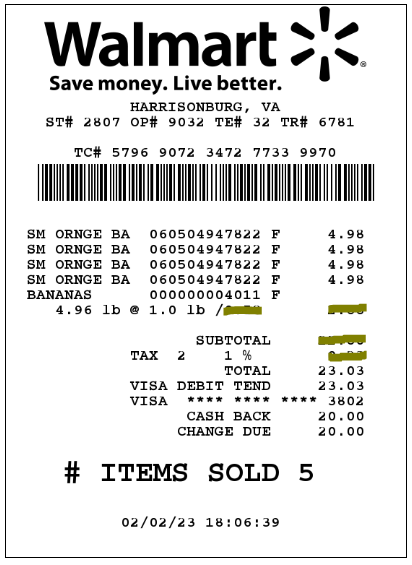

This is the receipt:

Let the subtotal (sum of the initial prices) of the items = p

$ (a.) \\[3ex] 1\% = \dfrac{1}{100} = 0.01 \\[5ex] \underline{Item} \\[3ex] Subtotal = p \\[3ex] Tax = 0.01(p) = 0.01p \\[3ex] Total\;\;price = p + 0.01p \\[3ex] = 1.01p...Calculated \\[3ex] = 23.03 ...Given \\[3ex] \implies \\[3ex] 1.01p = 23.03 \\[3ex] p = \dfrac{23.03}{1.01} \\[5ex] p = 22.8019802 \\[3ex] Subtotal \approx \$22.80 \\[3ex] (b.) \\[3ex] Tax = 0.01(22.8019802) = 0.228019802 \\[3ex] Tax \approx \$0.23 \\[3ex] (c.) \\[3ex] \underline{Four\;\;items} \\[3ex] Initial\;\;price = 4.98(4) = \$19.92 \\[3ex] \underline{Five\;\;items} \\[3ex] Subtotal = \$22.8019802 \\[3ex] Initial\;\;price\;\;of\;\;5th\;\;item \\[3ex] = 22.8019802 - 19.92 \\[3ex] = 2.8819802 \\[3ex] \approx \$2.88 \\[3ex] (d.) \\[3ex] Let\;\;unit\;\;price\;\;of\;\;5th\;\;item/pound = k \\[3ex] 4.96 * k = 2.8819802 \\[3ex] k = \dfrac{2.8819802}{4.96} \\[5ex] k = 0.5810443952 \\[3ex] Unit\;\;price \approx \$0.58 $

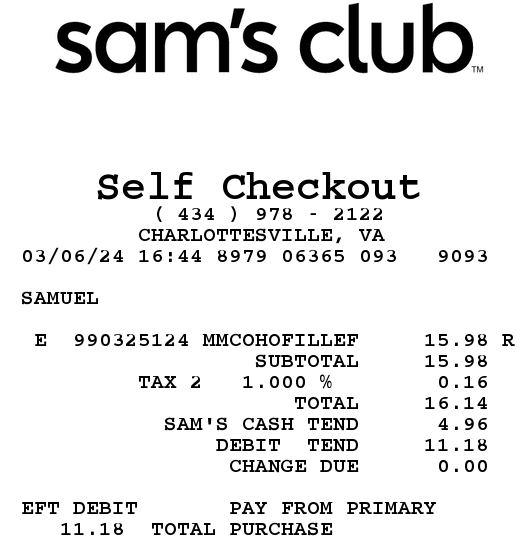

Case 5: Given: Tax, Sam's Club credit, Remaining balance (Use

$11.1798)

Calculate:

(a.) Total price

(b.) Initial price (Subtotal)

(c.) Tax rate

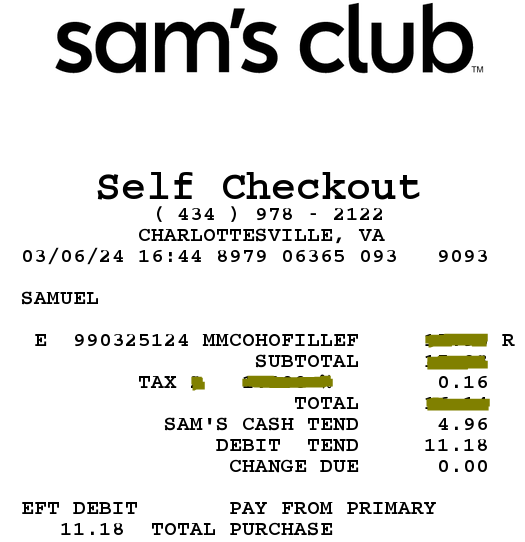

This is the receipt:

$ (a.) \\[3ex] Sam's\;\;club\;\;credit = \$4.96 \\[3ex] Remaining\;\;balance = \$11.1798 \\[3ex] Total\;\;price = 4.96 + 11.1798 \\[3ex] = 16.1398 \\[3ex] \approx \$16.14 \\[3ex] (b.) \\[3ex] Subtotal = Total\;\;price - Tax \\[3ex] = 16.1398 - 0.16 \\[3ex] = 15.9798 \\[3ex] \approx \$15.98 \\[3ex] (c.) \\[3ex] What\;\;\%\;\;of\;\;15.9798\;\;is\;\;0.16? \\[3ex] \underline{Percent-Proportion} \\[3ex] \dfrac{is}{of} = \dfrac{what\%}{100} \\[5ex] \dfrac{0.16}{15.9798} = \dfrac{what\%}{100} \\[5ex] what\% = \dfrac{0.16 * 100}{15.9798} \\[5ex] what\% = 1\% \\[3ex] Tax\;\;percent = 1\% $

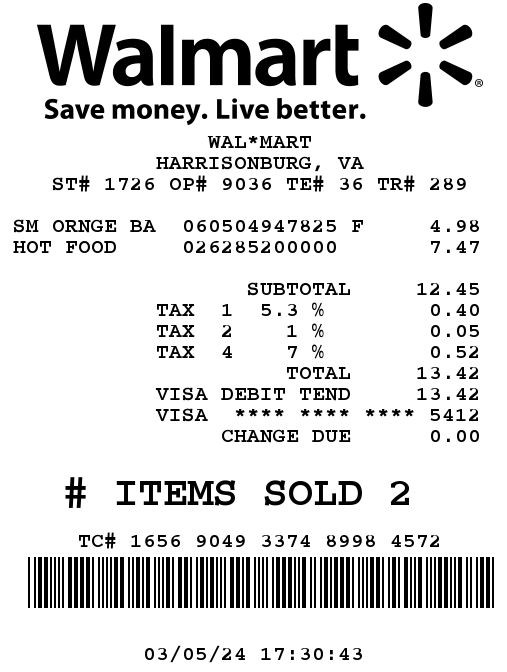

Case 6: As at March 2024, the City of Harrisonburg in the State of Virginia charges 1%

sales tax on raw foods and fruits and a high tax rate

on cooked food.

(I guess they want Virginians to cook their meals.)

Chukwuemeka was hungry and decided to buy hot food at Walmart.

The hot food is high in calories and is a source of carbohydrates (carbs).

He also decided to buy a bag of fresh oranges to provide essential vitamins.

The receipt shows three tax rates: the tax rate on the oranges (shown) and two different tax

rates on the hot food (not shown).

Given:

(I.) Initial price of the bag of oranges

(II.) Initial price of the hot food

(III.) Tax rate on the bag of oranges

(IV.) Tax on the bag of oranges

(V.) 1st tax on the hot food (Use $0.39591)

(VI.) 2nd tax on the hot food (Use $0.5229)

Calculate:

(a.) Subtotal (Sum of the initial prices)

(b.) 1st tax rate on the hot food

(c.) 2nd tax rate on the hot food

(d.) Total price

This is the receipt:

$ (a.) \\[3ex] Subtotal = 4.98 + 7.47 \\[3ex] Subtotal = \$12.45 \\[3ex] (b.) \\[3ex] What\;\;\%\;\;of\;\;7.47\;\;is\;\;0.39591? \\[3ex] \underline{Percent-Proportion} \\[3ex] \dfrac{is}{of} = \dfrac{what\;\%}{100} \\[5ex] \dfrac{0.39591}{7.47} = \dfrac{what\;\%}{100} \\[5ex] what\;\% = \dfrac{0.39591 * 100}{7.47} \\[5ex] what\;\% = 5.3\% \\[3ex] 1st\;\;tax\;\;rate = 5.3\% \\[3ex] (c.) \\[3ex] What\;\;\%\;\;of\;\;7.47\;\;is\;\;0.5229? \\[3ex] \underline{Percent-Equation} \\[3ex] \dfrac{what}{100} * 7.47 = 0.5229 \\[5ex] what = \dfrac{0.5229 * 100}{7.47} \\[5ex] what = 7 \\[3ex] 2nd\;\;tax\;\;rate = 5.3\% \\[3ex] (d.) \\[3ex] Total\;\;price = 12.45 + 0.39591 + 0.05 + 0.5229 \\[3ex] = 13.41881 \\[3ex] \approx \$13.42 $

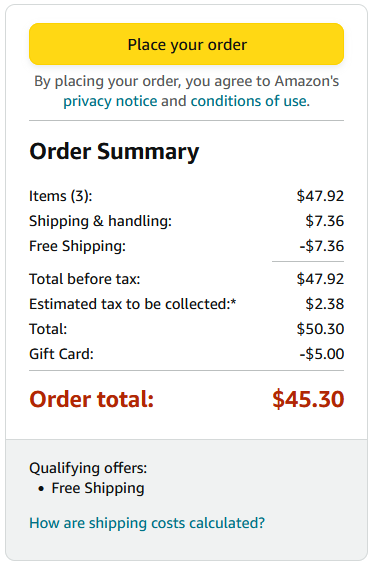

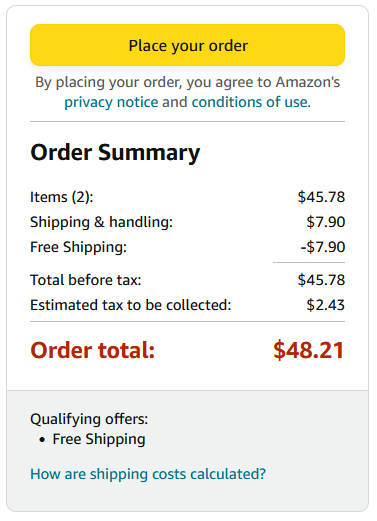

Case 7: Samuel placed two different online orders on two different days on the

Amazon website.

The two different orders were sent to the same address in the State of Virginia.

None of the orders has food or drinks.

However, the orders were charged different tax rates.

1st Order:

2nd Order:

(a.) Calculate the tax rate for the 1st order.

(b.) Calculate the tax rate for the 2nd order.

(c.) Samuel asked you to explain why the tax rates were different.

(i.) Ask Samuel at least one question in that regard.

(ii.) Provide at least one explanation to Samuel.

Let the subtotal (sum of the initial prices) of the items = p

$ (a.) \\[3ex] \underline{1st\;\;Order} \\[3ex] What\;\;\%\;\;of\;\;47.92\;\;is\;\;2.38? \\[3ex] \underline{Percent-Equation} \\[3ex] \dfrac{what}{100} * 47.92 = 2.38 \\[5ex] what = \dfrac{2.38 * 100}{47.92} \\[5ex] what = 4.966611018 \\[3ex] Tax\;\;rate = 4.966611018\% \\[3ex] (b.) \\[3ex] \underline{2nd\;\;Order} \\[3ex] What\;\;\%\;\;of\;\;45.78\;\;is\;\;2.43? \\[3ex] \underline{Percent-Proportion} \\[3ex] \dfrac{is}{of} = \dfrac{what\;\%}{100} \\[5ex] \dfrac{2.43}{45.78} = \dfrac{what\;\%}{100} \\[5ex] what\;\% = \dfrac{2.43 * 100}{45.78} \\[5ex] what\;\% = 5.307994758\% \\[3ex] Tax\;\;rate = 5.307994758\% $

Case 8: Given:

(I.) Two items:

2nd item is 20LB GV HML

1st item is GE STRT JEA

Note the interchange here as opposed to the receipt

(II.) Subtotal of the two items

(III.) Different tax rates for the two items

(Tax 1 for the 1st item and Tax 2 for the 2nd item)

(IV.) Different taxes for the two items

(Use $0.84694 for the 1st item and $0.1674 for the 2nd item)

(V.) Total price

Calculate:

(a.) Initial price of the 1st item

(b.) Initial price of the 2nd item

This is the receipt:

Let the:

initial price of the 1st item = c

initial price of the 2nd item = d

$ \underline{Items} \\[3ex] Subtotal = \$32.72 \\[3ex] c + d = 32.72 ...eqn.(1) \\[5ex] \underline{Taxes} \\[3ex] Tax\;\;rate\;1 = 5.3\% = \dfrac{5.3}{100} = 0.053 \\[5ex] Tax\;\;rate\;2 = 1\% = \dfrac{1}{100} = 0.01 \\[5ex] Tax\;1 = \$0.84694 \\[3ex] Tax\;2 = \$0.1674 \\[3ex] Sum\;\;of\;\;taxes = 0.84694 + 0.1674 = 1.01434 \\[3ex] 0.053c + 0.01d = 1.01434...eqn.(2) \\[5ex] \underline{Elimination\;\;by\;\;Subtraction\;\;Method} \\[3ex] 100 * eqn.(2) \implies \\[3ex] 5.3c + d = 101.434...eqn.(3) \\[3ex] eqn.(3) - eqn.(1) \implies \\[3ex] (5.3c + d) - (c + d) = 101.434 - 32.72 \\[3ex] 5.3c + d - c - d = 68.714 \\[3ex] 4.3c = 68.714 \\[3ex] c = \dfrac{68.714}{4.3} \\[5ex] c = 15.98 \\[3ex] \underline{Substitution\;\;Method} \\[3ex] From\;\;eqn.(1) \\[3ex] d = 32.72 - c \\[3ex] d = 32.72 - 15.98 d = 16.74 \\[3ex] Initial\;\;price\;\;of\;\;the\;\;1st\;\;item = \$15.98 \\[3ex] Initial\;\;price\;\;of\;\;the\;\;2nd\;\;item = \$16.74 $

Case 9: Given:

(I.) Initial price

(II.) Discount

(III.) Percent Discount

(IV.) Sale price

But:

The percent discount on the label is an approximate value.

Calculate the exact percent discount.

We have several approaches to solve this question.

Use any approach you prefer.

$ Initial\;\;price = 2.70\;lb * \dfrac{\$8.98}{1\;lb} = \$24.246 \\[5ex] Sale\;\;price = 2.70\;lb * \dfrac{\$6.98}{1\;lb} = \$18.846 \\[5ex] \underline{Algebraic\;\;Thinking} \\[3ex] Let\;\;\%\;discount = p \\[3ex] p\% = \dfrac{p}{100} = 0.01p \\[5ex] Discount = p\%\;\;of\;\;24.246 \\[3ex] = 0.01p(24.246) \\[3ex] = 0.24246p \\[3ex] Sale\;\;price = p\%\;\;off\;\;24.246 \\[3ex] = 24.246 - 0.24246p \\[3ex] \implies \\[3ex] 24.246 - 0.24246p = 18.846 \\[3ex] 24.246 - 18.846 = 0.24246p \\[3ex] 0.24246p = 5.4 \\[3ex] p = \dfrac{5.4}{0.24246} \\[5ex] p = 22.27171492 \\[3ex] \therefore \%\;discount = 22.27171492\% \\[5ex] \underline{Percent-Proportion} \\[3ex] What\;\;\%\;\;of\;\;24.246\;\;is\;\;18.846? \\[3ex] \dfrac{is}{of} = \dfrac{what\;\%}{100} \\[5ex] \dfrac{18.846}{24.246} = \dfrac{what\;\%}{100} \\[5ex] what\;\% = \dfrac{18.846 * 100}{24.246} \\[5ex] what\;\% = 77.72828508\% \\[3ex] \%\;discount = 100\% - 77.72828508\% \\[3ex] \%\;discount = 22.27171492\% $

Project Requirements

(1.) Independent Study: This is an individual project.

You may collaborate with another student. However, it is an individual project.

It is not a group project.

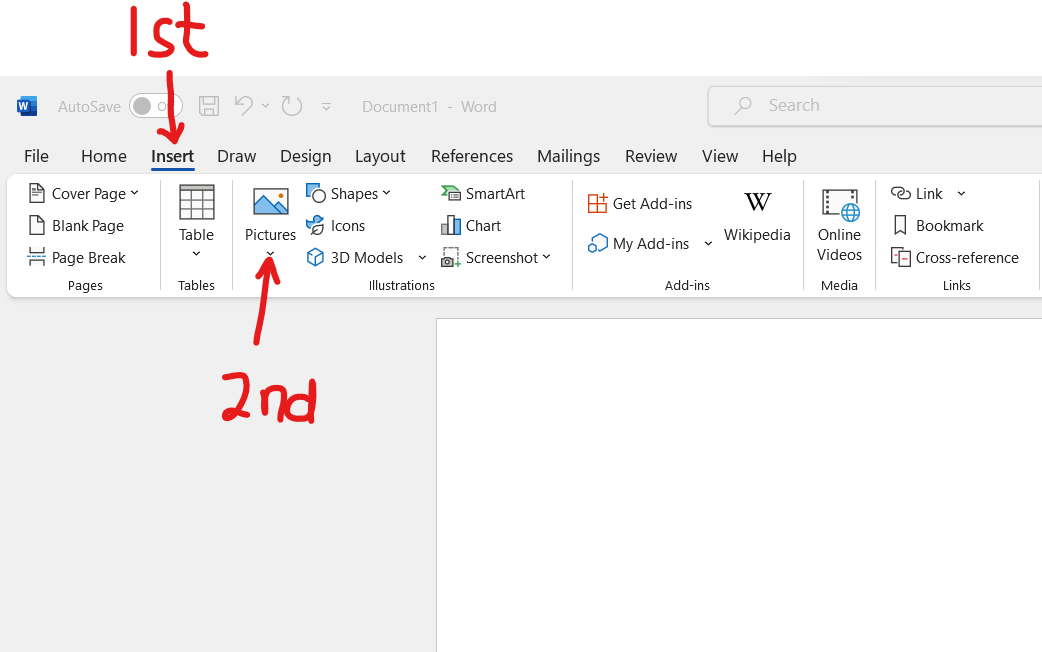

(2.) The image of every receipt you use must be clear, sharp, and taken on a good background.

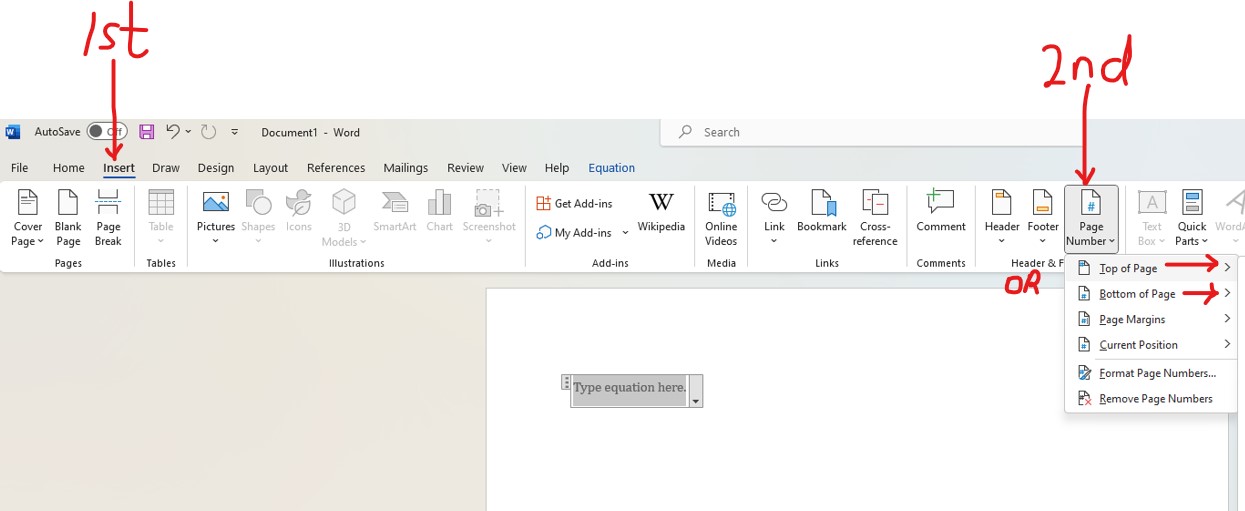

Please use the Insert → Pictures icon to insert the image directly.

(3.) Critical Thinking: I did 10 different cases as seen in the Example Guides.

More cases will be added as I find more receipts/labels with applicable challenge levels.

These cases involved the calculations of these variables:

(A.) Initial price (Subtotal)

(B.) Tax rate

(C.) Tax

(D.) Total price

(E.) Discount

(F.) Percent discount

But, did you notice I did not do these variables?

(G.) Markup

(H.) Percent markup

It is for you to do if you wish.

(a.) Do at least 5 different cases.

At least one case should include a Discount and/or Percent Discount and/or a Markup and/or Percent

Markup.

(b.) Actual receipts should be used as best as you can.

However, if you cannot find an actual receipt or if you do not have the means to get an actual receipt:

Creativity and Technology Skills:

(i.) If you do not see any actual receipt/label involving markup and/or percent markup, use a suitable

software technology to

design the receipt/label.

(ii.) If you do not see any actual receipt/label involving discount and/or percent discount, use a

suitable software technology to

design the receipt/label.

(iii.) If you do not see any actual receipt/label involving the other cases, please contact me so I give

you the receipts.

(4.) English Language/Writing Skills: Using proper English Language grammar, write word problems

for each case.

Make sure you use words such as: percent, tax, tax rate, include, exclude, included, excluded, of,

and off among others.

(5.) Typing Skills: As a student, you most likely have free access to Microsoft Office suite of

apps.

(a.) Please use the computers in the Computer Lab of your school.

If you prefer to use your computer, please download the desktop apps of Microsoft Office on your

desktop/laptop (Windows and/or Mac only).

Do not use a chromebook.

Do not use a tablet/iPad.

Do not use a smartphone.

Do not use the web app/sharepoint access of Microsoft Office.

(Please contact the IT/Tech Support for assistance if you do not know how to download the desktop

app.)

In that regard, the project is to be typed using the desktop version/app of Microsoft Office Word

only.

(b.) The file name for the Microsoft Office Word project should be saved as:

firstName–lastName–project

Use only hyphens between your first name and your last name; and between your last name and the word,

project.

No spaces.

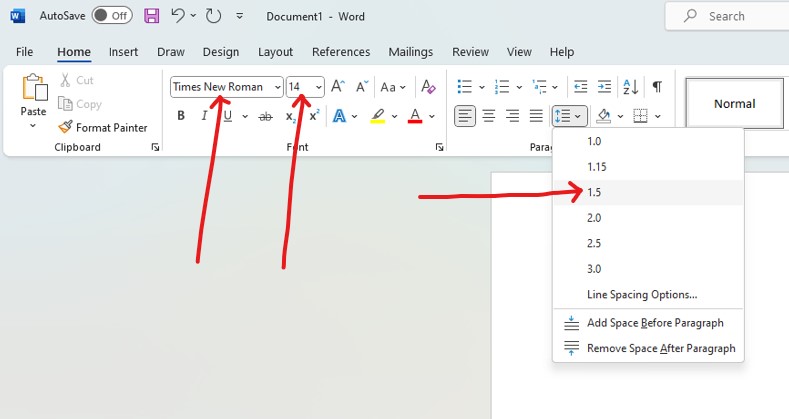

(c.) For all English terms (entire project): use Times New Roman; font size of 14; line spacing of 1.5

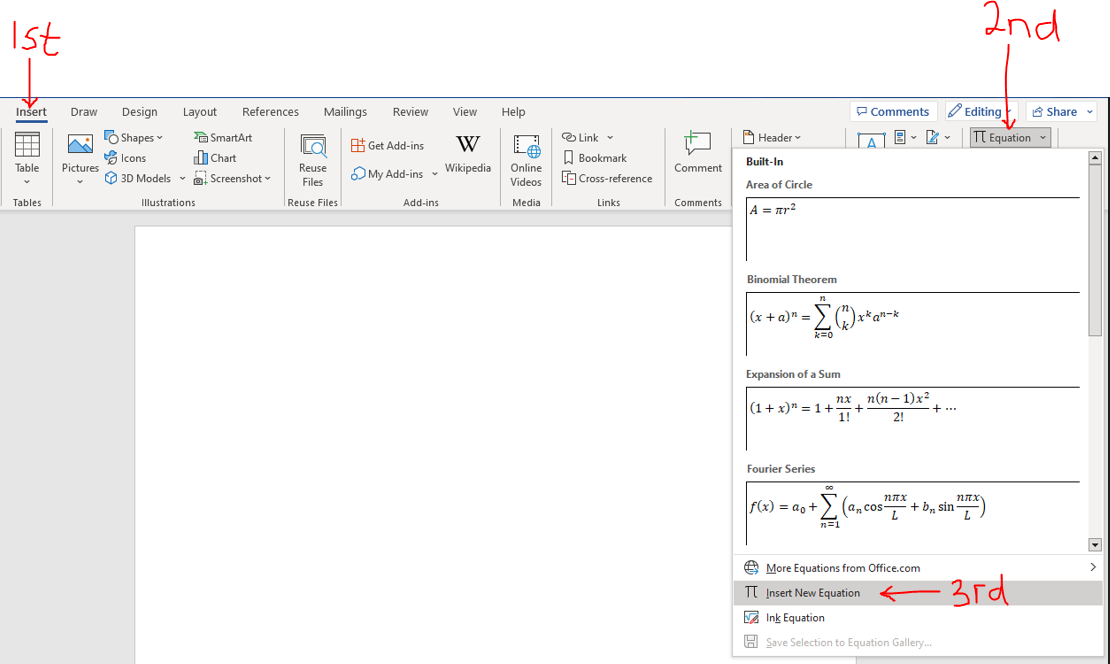

(d.) For all Math terms/work: symbols, variables, numbers, formulas, expressions, equations and

fractions among others,

the Math Equation Editor is required.

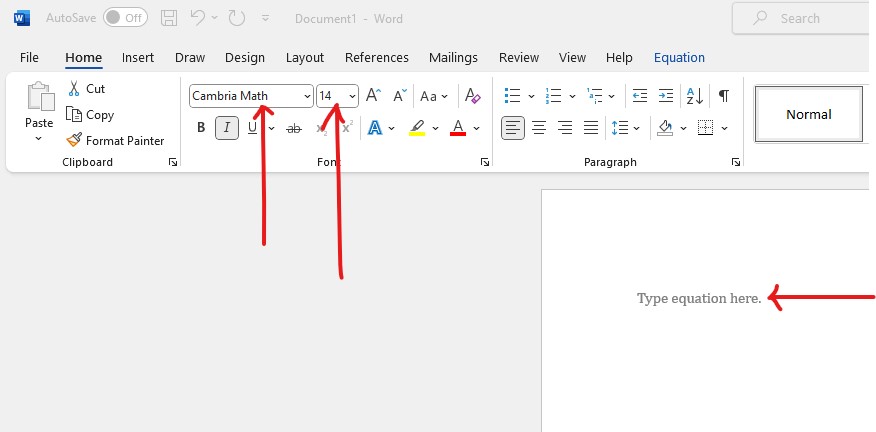

(i.) The font is set to Cambria Math by default (set it to that font if it is not); font size of 14, and

align accordingly (preferably left-aligned).

(ii.) To ensure appropriate spacing between your Math work, use a line spacing of 2.0.

Alternatively, you may use line spacing of 1.5 but insert a space after each equation as applicable.

Your work should be well-formatted, organized, well-spaced (not compact), and visually appealing.

(e.) Include page numbers. You may include at the top of the pages or at the bottom of the pages but not

both.

(6.) Mathematical Skills/Reasoning: and Critical Thinking Skills:

(a.) Write any formula that you use.

(b.) Show all work.

(c.) Do not approximate intermediate calculations.

(d.) Approximate final answers accordingly.

(e.) The exact values must be shown prior to the approximate values.

(f.) Cases 3, 5, 6, 8: Notice the values I used in those cases. I used those values to get the values on

the receipts. In that same sense, you

may need to specify the values you used to get the values on the receipts.

(6.) Mr. C (SamDom For Peace) wants you to do this real-world project very well.

Hence, he highly recommends that you submit a draft so he can give you feedback.

(a.) First: (Required): Please submit clear images of the receipts in the Projects:

Receipts page in the Canvas course.

I shall review and respond.

(b.) Second: (Highly Recommended): When your receipts are approved, please submit your draft.

Draft projects are not graded because they are drafts. They are only for feedback.

If your professor gives you an opportunity to submit a draft, please use that opportunity.

Submitting drafts is highly recommended. Submitting drafts is not required.

It is highly recommended because I want to give you the opportunity to do your project very well and

make an excellent

grade in it.

Please turn in your draft in the Discussions page → Projects: Drafts forum in

the Canvas course

(if you would like your colleagues to read my comments and avoid any mistakes that you made).

You may also send it to me via email (if you do not want your colleagues to see my comments and learn

from the

comments).

I shall review and provide feedback.

Then, review my feedback and make changes as necessary.

Keep working with me until I give you the green light to turn in your actual project. This must

be done before

the final due date to turn in the actual project.

When everything is fine (after you make changes as applicable based on my feedback), please submit your

work in the appropriate area: Assignments page → Receipts Project in the Canvas

course.

Only the projects submitted in the appropriate place in the Canvas course are graded.

(7.) All work must be turned in by the final due date to receive credit.

Please note the due dates listed in the course syllabus for the submission of the draft and the actual

project.

In the course syllabus, we have the:

(a.) Initial due date for the Project Draft: Please turn in your draft.

(b.) Initial due date for the Project: If your draft is not ready for submission, keep working with me.

Make changes

based on my feedback and keep working with me.

If you prefer not to turn in a draft, please review all the resources provided for you and do your

project well and

submit.

(c.) Final due date for the Project Draft: This is necessary if you want a written feedback for your

draft.

After this date, written feedback would not be provided for your draft. However, verbal feedback would

still be provided

during Office Hours/Student Engagement Hours/Live Sessions.

(d.) Final due date for the Project: All work must be turned in by this date to receive credit.

After this date, no work may be accepted.

| Name: | Your name |

| Date: | The date |

| Instructor: | Samuel Chukwuemeka |

| Project: | Percent Application: Receipts |

| Objectives: |

Please write the objectives. Number them accordingly. |

| Cases: |

Please write each case. Number them accordingly. Insert the receipt for each case. Do the calculations for each case. |

| Citation: |

Indicate the type of citation format. Cite your source(s) accordingly. |

Student Project Samples

Sample 1: Ryan: Percent Application: Receipts ProjectSample 2: Velasquez: Percent Application: Receipts Project

Sample 3: Nieto: Percent Application: Receipts Project

The teacher should guide each student to the successful completion of the project.

Let students know you are willing to help.

References

Chukwuemeka, S.D (2024, March 10). Samuel Chukwuemeka Tutorials: Math, Science, and Technology.

Retrieved from https://quantitativereasoning.appspot.com/