The Mathematics of Finance using Texas Instruments Graphing Calculators

Welcome to VMATYC 2025 and to our Session

I greet you this day,

My name is Samuel Dominic Chukwuemeka (also known as SamDom For Peace).

I appreciate your attendance to this session.

If you do not mind, may we please take little time to introduce one another?

Name:

School/College/University:

Courses you teach:

Single Three-Year Software License Request Form

You may request for a complimentary three-year software license by completing the form at: https://ti-enews-education.ti.com/syllabus

You may use any of these TI calculators:

TI-83 Plus

TI-84 Plus series

TI-Nspire CX series

TI-89 Titanium

TI-73 Explorer

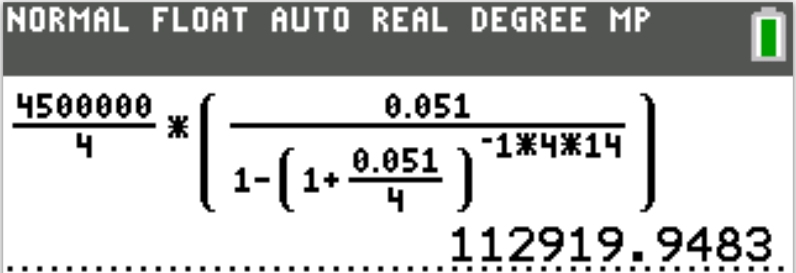

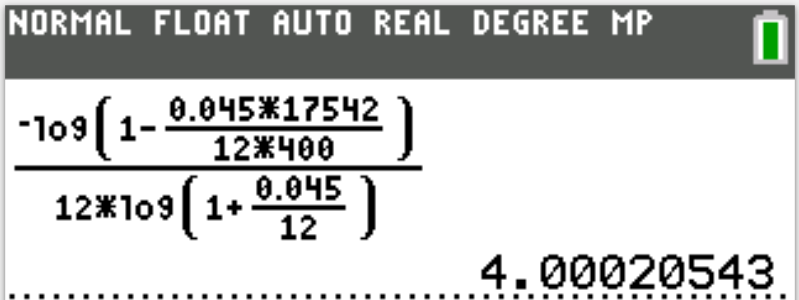

There are at least two approaches to using the TI-calculators for finance problems.

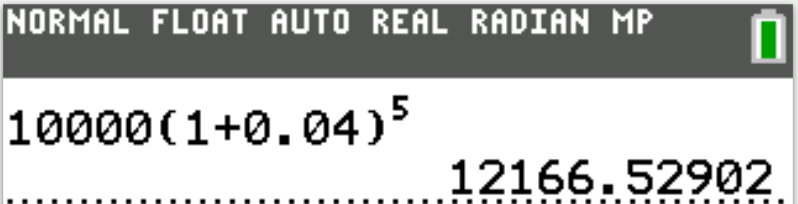

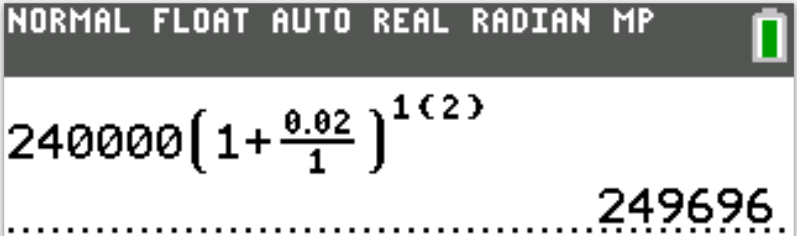

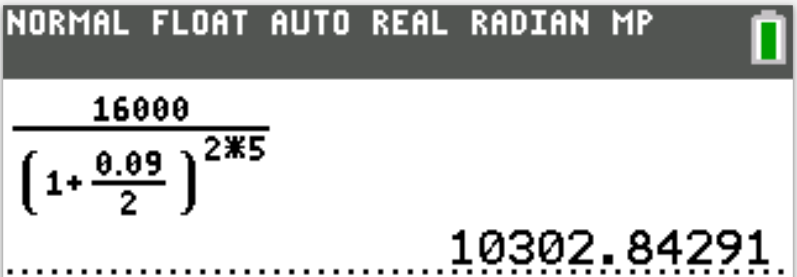

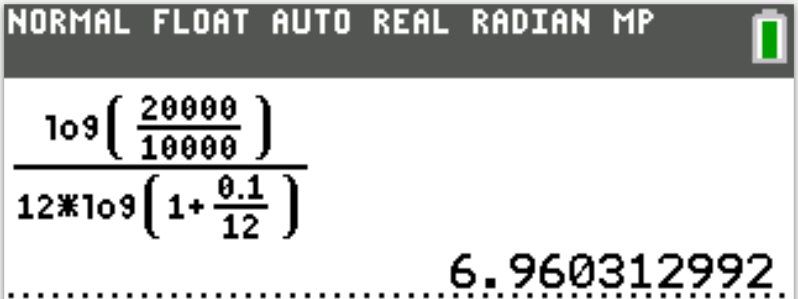

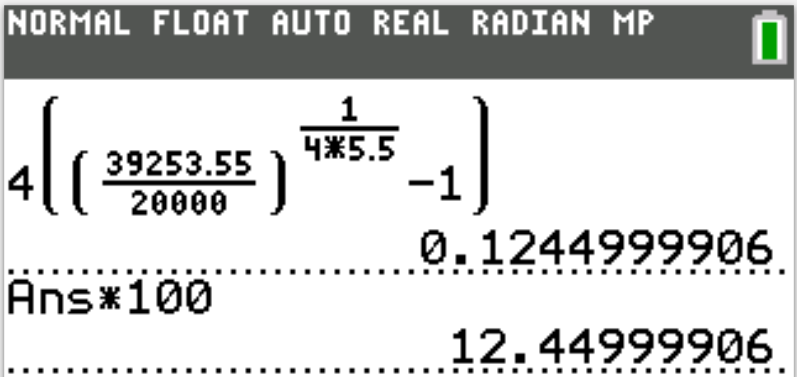

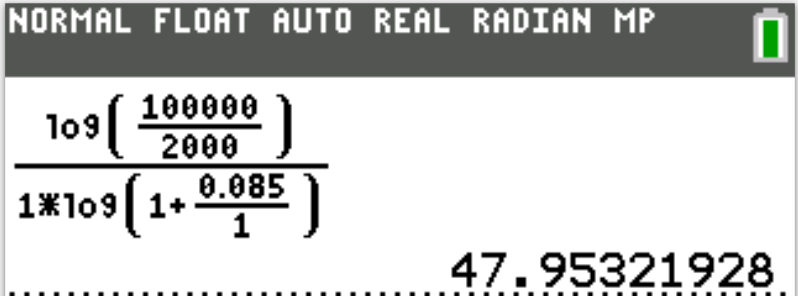

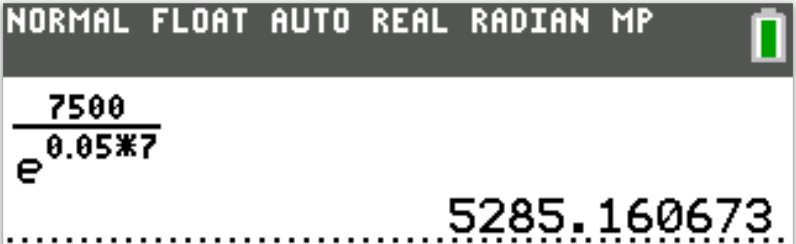

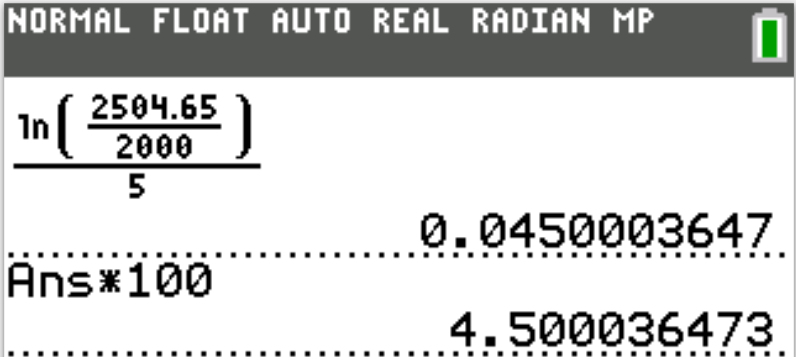

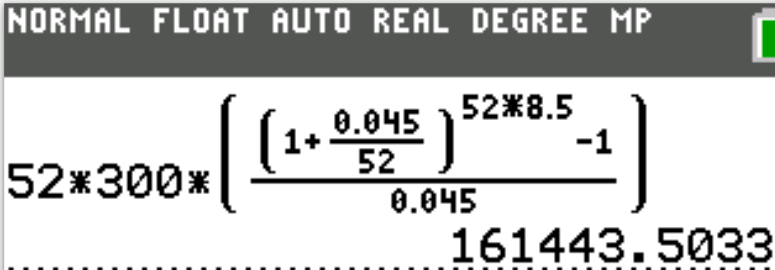

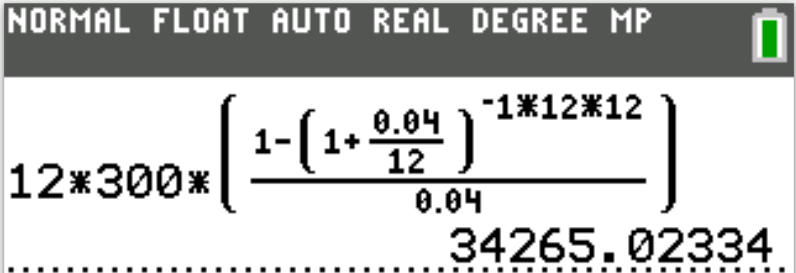

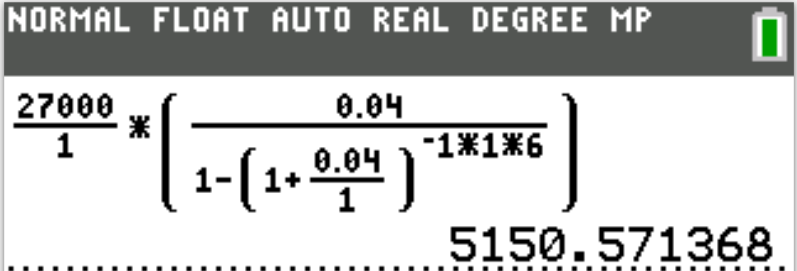

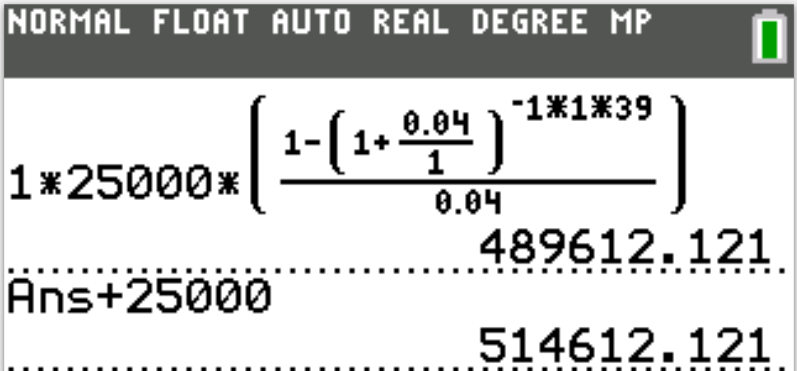

1st Approach: Direct Input of Substituted Values

(1.) Find the applicable

Formula

(2.) Substitute the values directly in the formula.

(3.) Enter it directly in the calculator.

(Please see Show/Hide Answer for examples.)

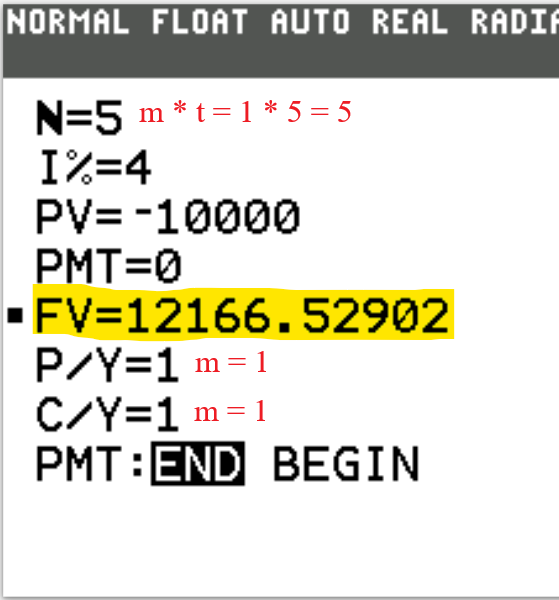

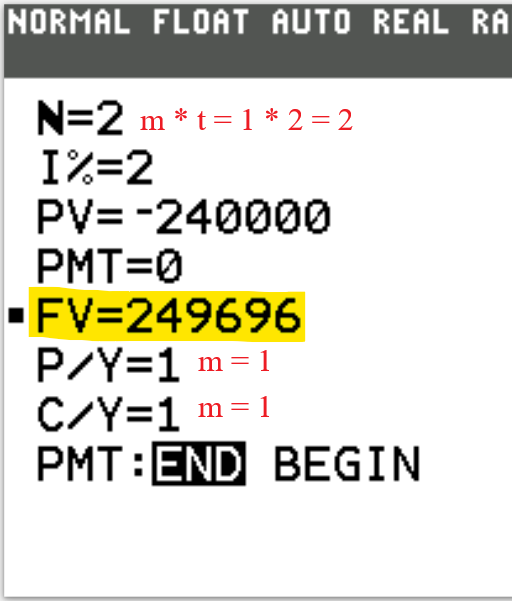

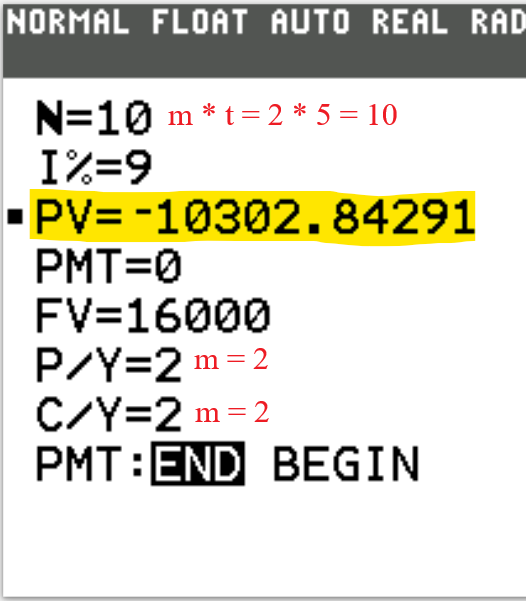

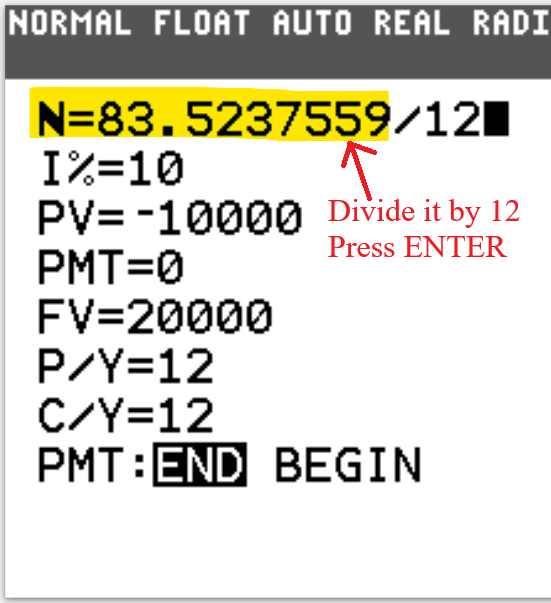

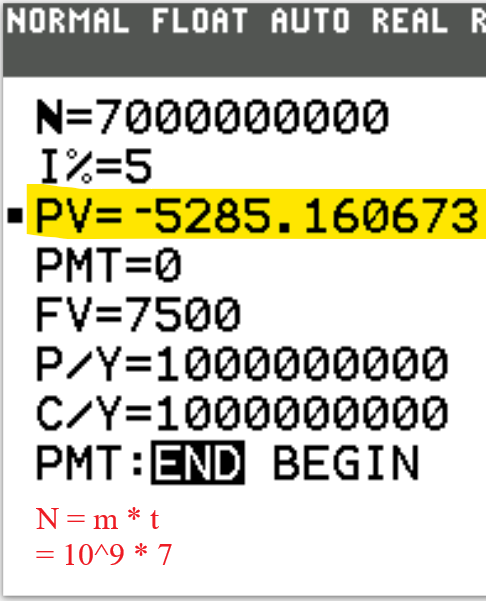

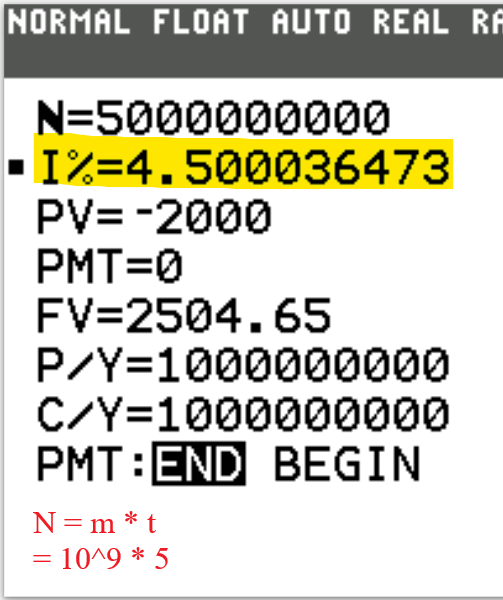

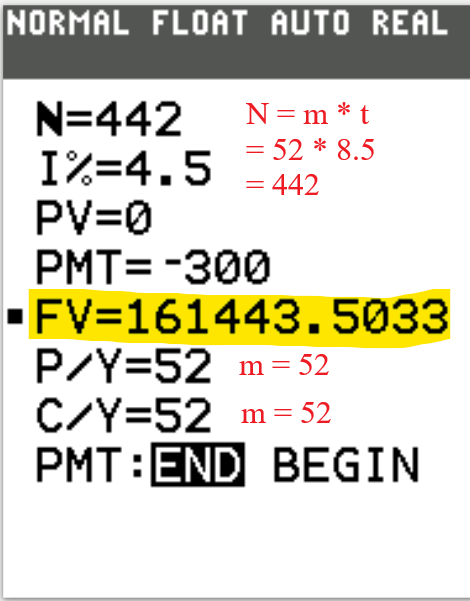

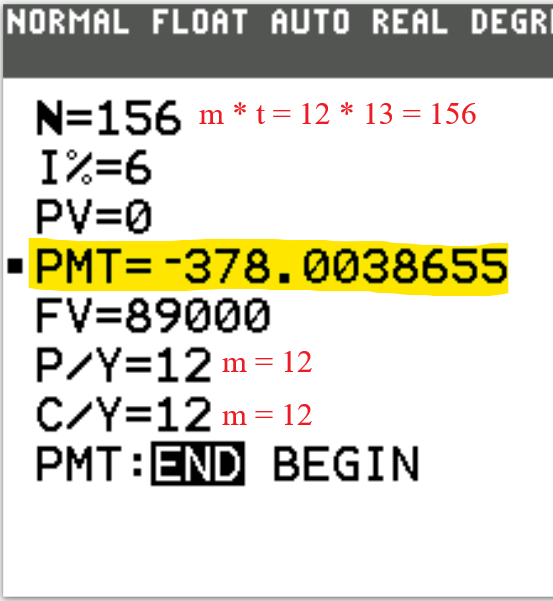

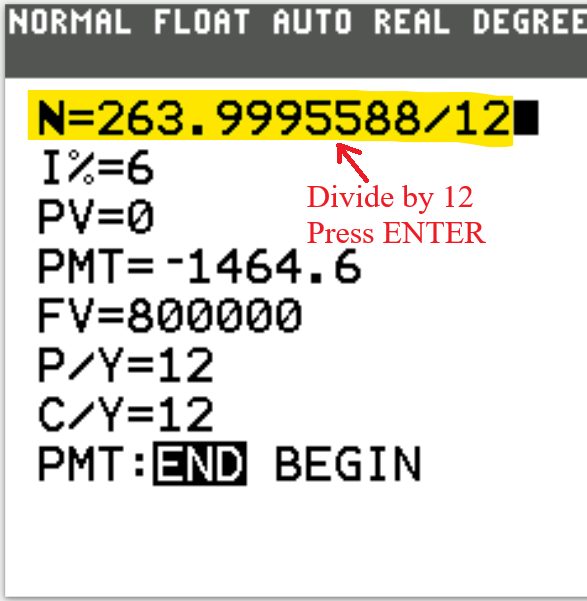

2nd Approach: Time Value of Money (TVM) Solver

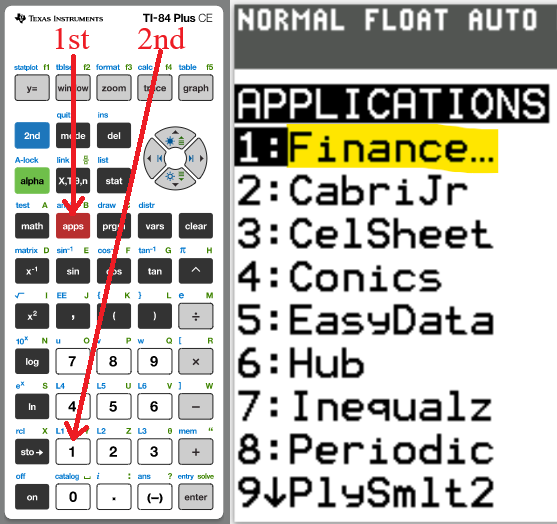

The Finance app is required.

It can be assessed by pressing the APPS button, then pressing the 1: Finance app

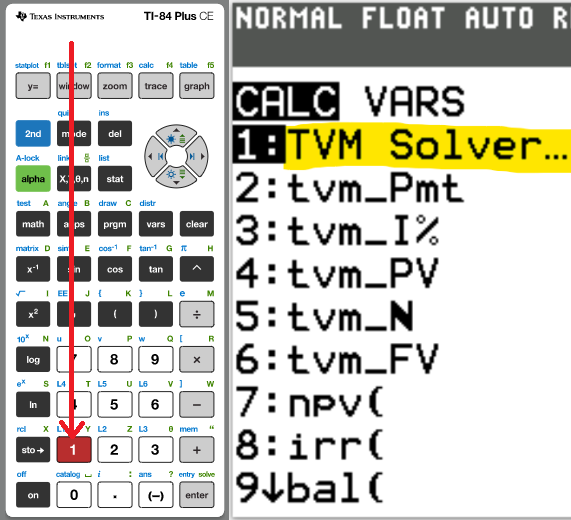

We begin with the TVM Solver (known as the Time Value of Money Solver) which is found as the first app

under the CALC menu (CALC → 1: TVM Solver ...)

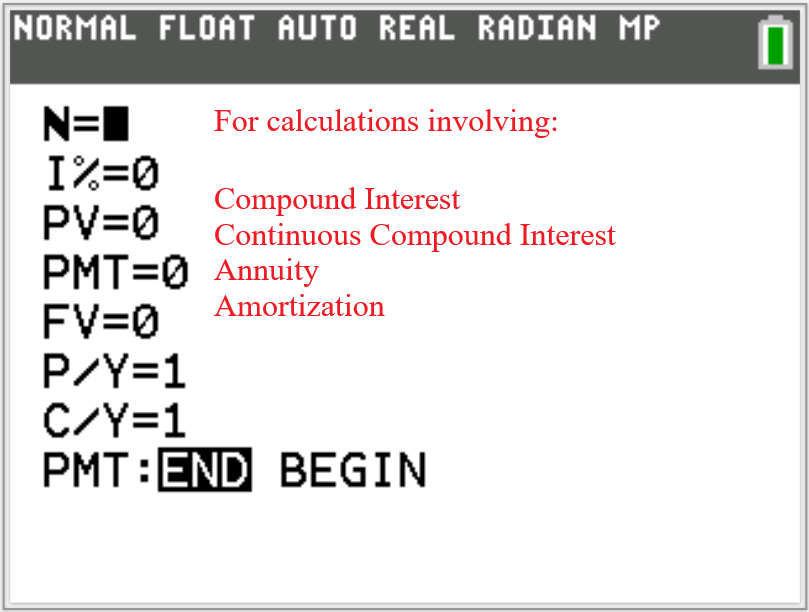

For calculations involving:

Compound Interest

Continuous Compound Interest

Annuity

Amortization

We use the TVM-Solver

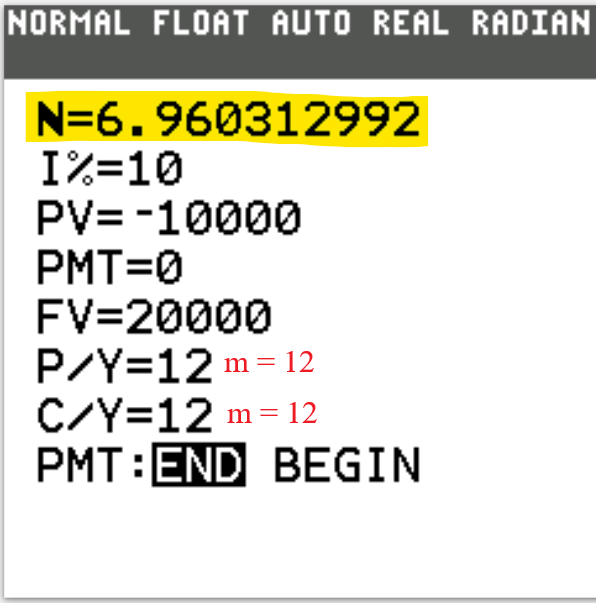

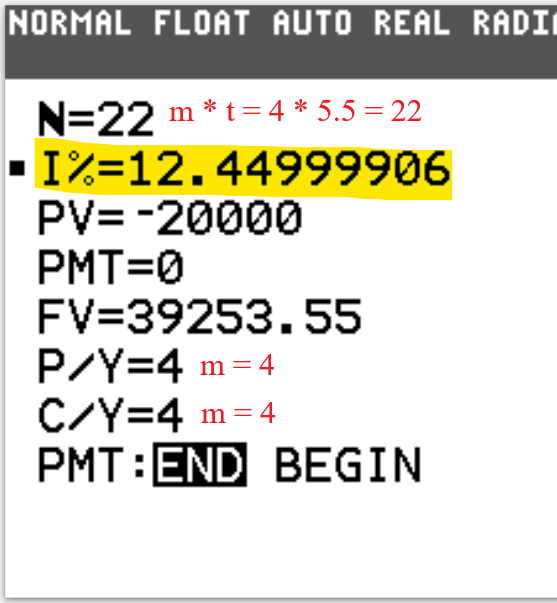

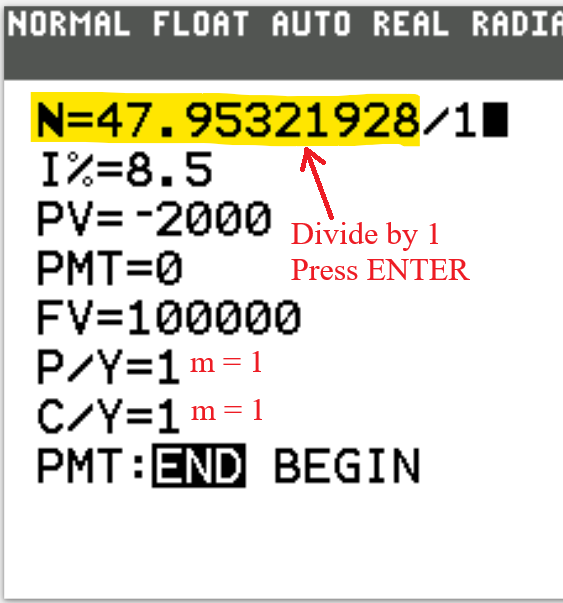

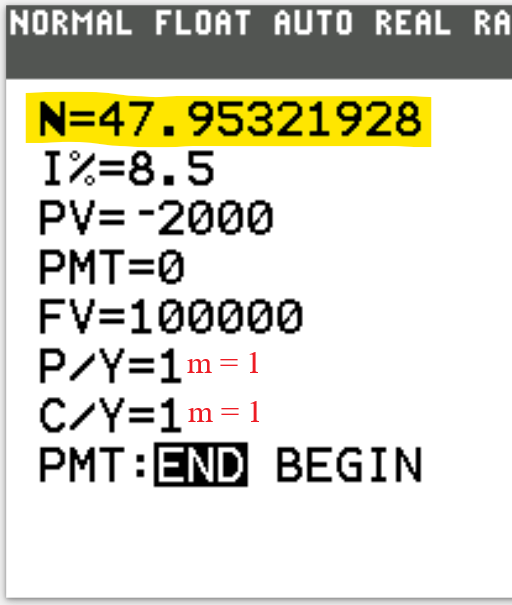

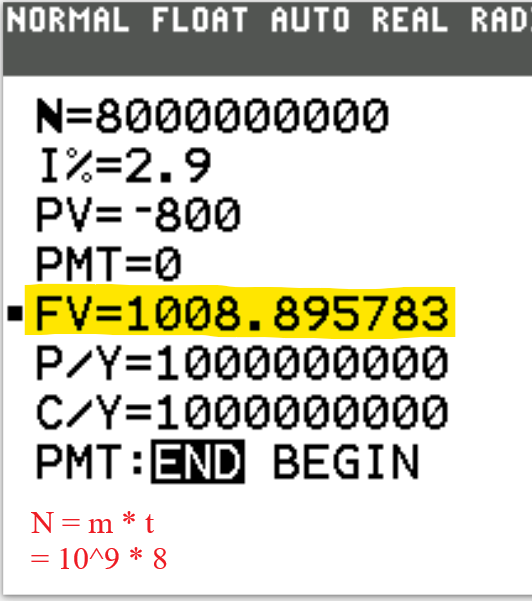

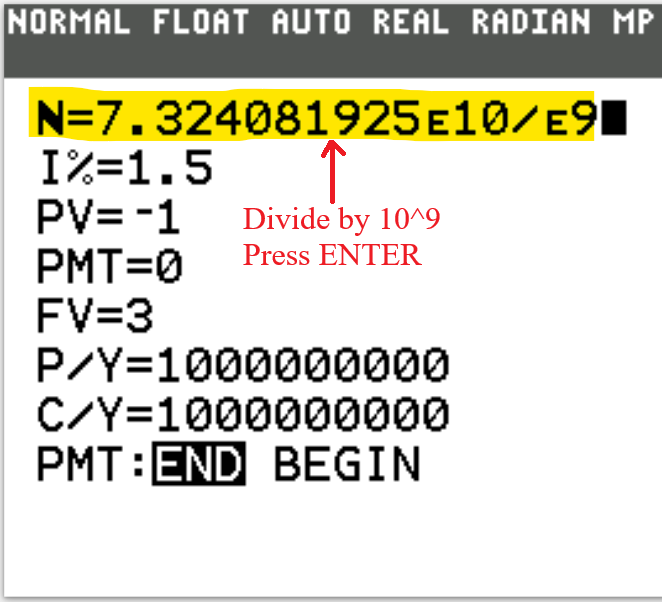

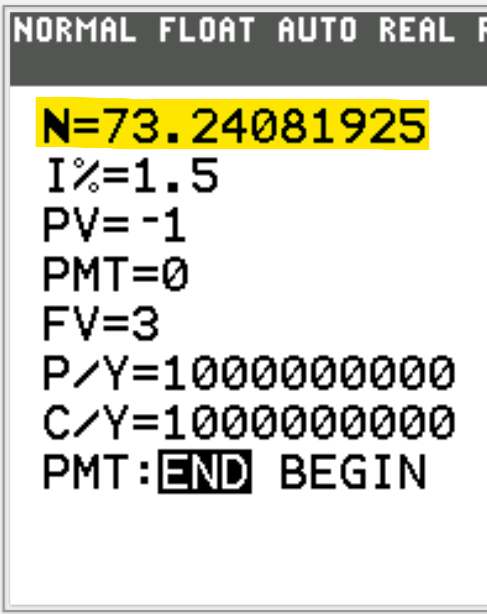

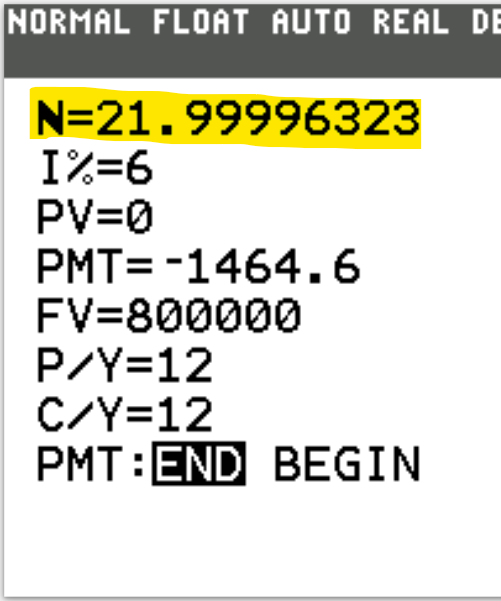

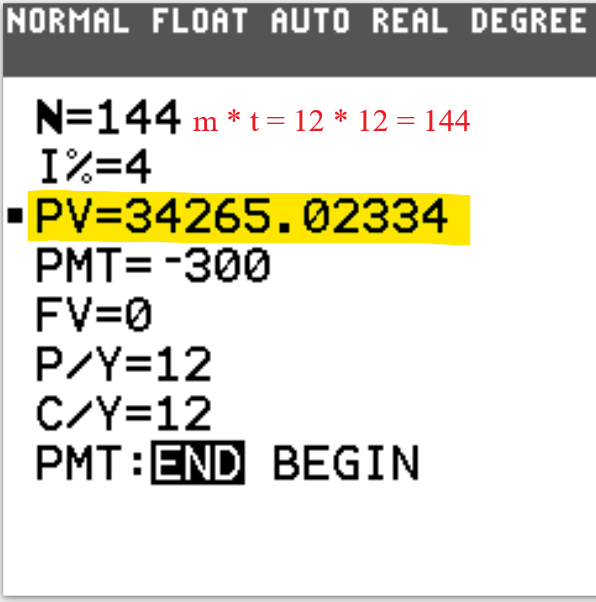

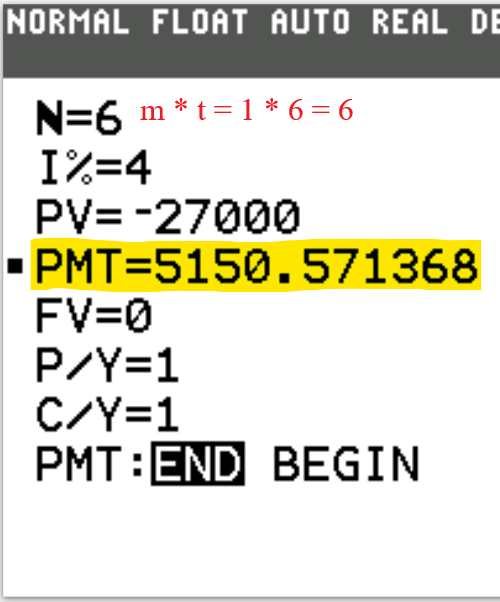

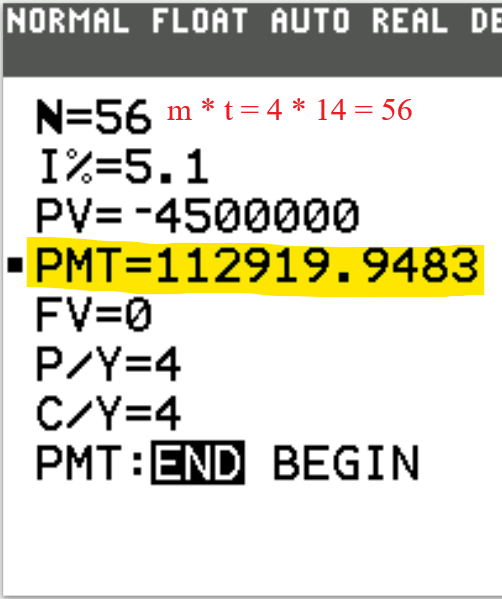

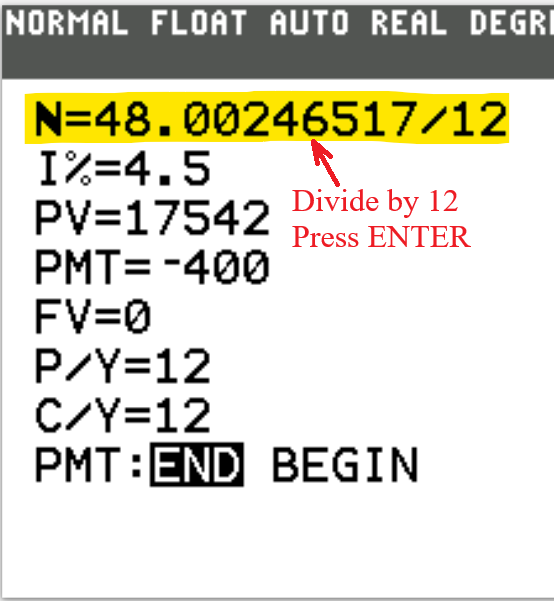

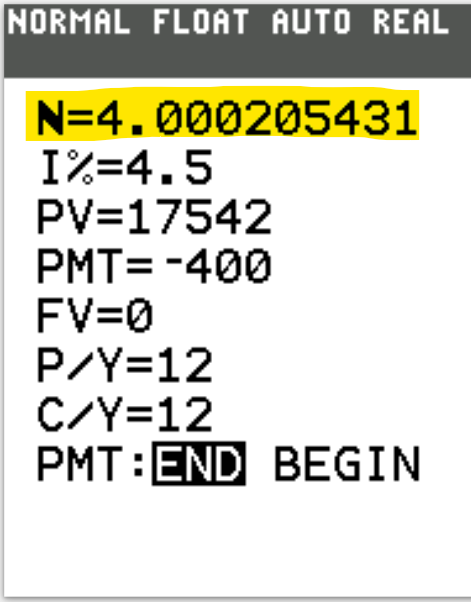

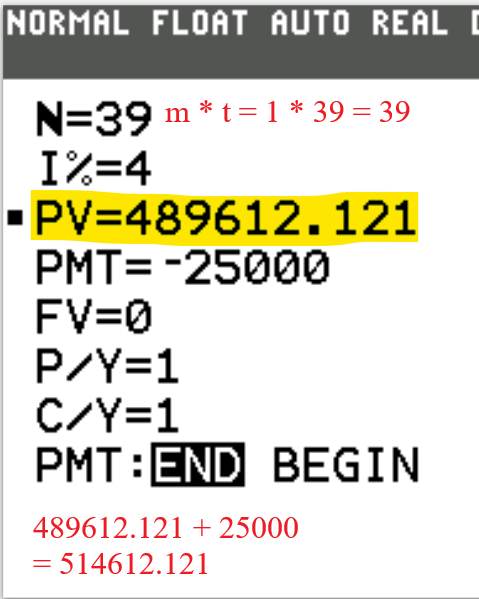

N is the total number of compounding periods (years).

$N = mt$

This is the product of the number of compounding periods per year and the time (in years).

I% is the interest rate.

If it is 3%, type 3. Do not include the %.

PV is the present value.

This is the Principal or Investment

PMT is the periodic payment.

This specifically applies to Annuity and Amortization.

FV is the future value.

This is the Amount.

P/Y is the number of payments per year.

C/Y is the number of compounding periods per year.

For Compound Interest and Continuous Compound Interest calculations, $P/Y = C/Y$

PMT:END:BEGIN Is the payment made at the end or at the beginning of the year?

Notable Notes:

(1.) No field should be blank.

Put a value in every field.

If the field does not apply for the question, put a 0 in that field.

For the value that you would like to find, put 0 initially.

(2.) For any cash outflow, put a negative sign.

For any cash inflow, put a positive sign.

(3.) Indicate whether the payment is made at the END or at the BEGIN of a period.

When the black focus is on any of those options, move to the field that you want to calculate.

(4.) Clear the 0 that you put in initially in that field.

Press the ALPHA key

That takes us to the SOLVE menu which is above the ENTER key. So, press the ENTER key.

That gives the value of what you want to calculate.

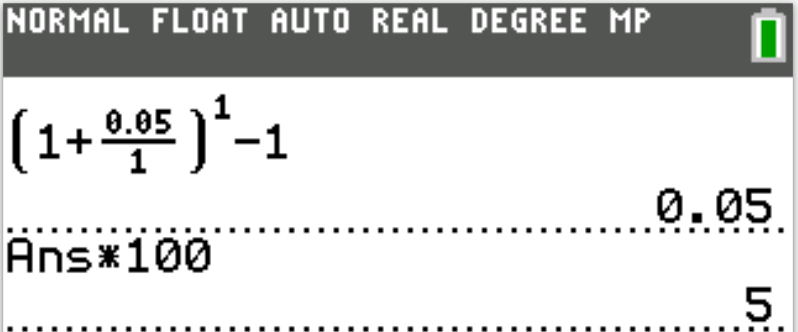

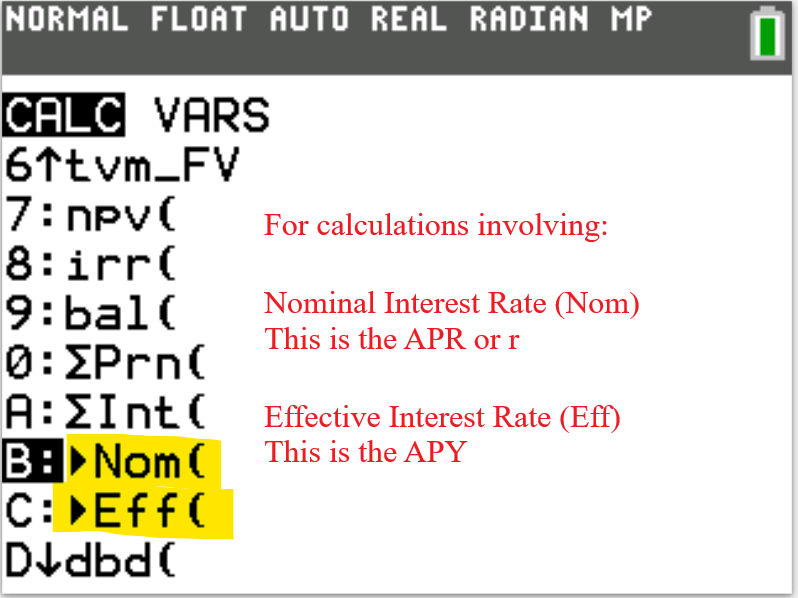

For calculations involving:

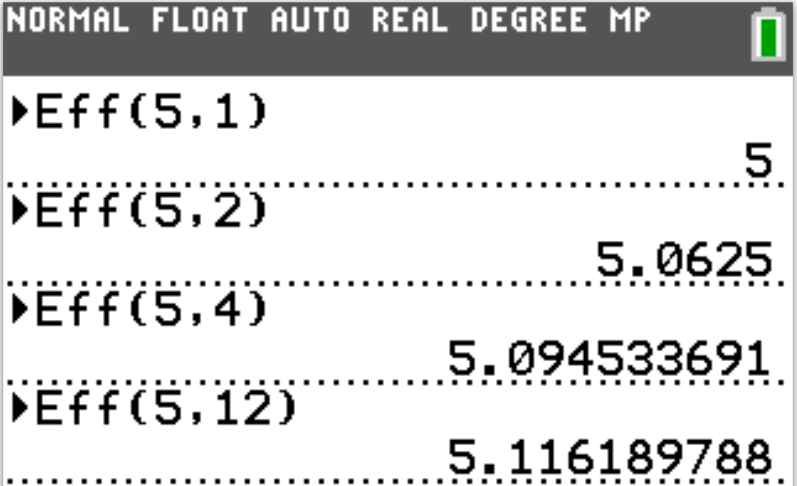

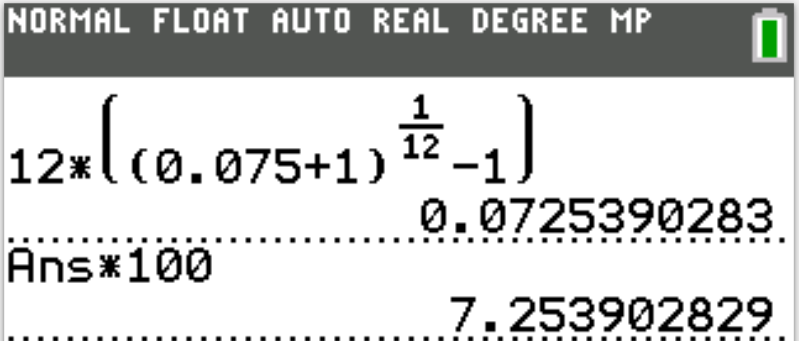

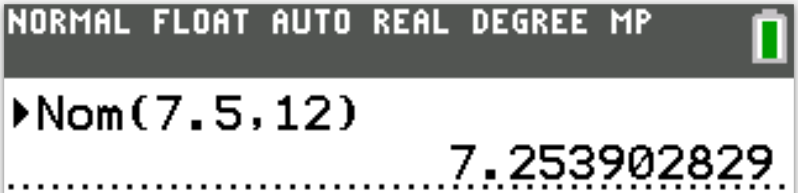

Annual Percentage Rate

Annual Percentage Yield

We use the Eff and Nom functions as applicable.

Use the codes as applicable:

Nom(APY, m)

Eff(APR, m)

Comments, ideas, areas of improvement, questions, and constructive criticisms are welcome at anytime before,

during or after the presentation.

Let us discuss the examples.

Thank you.

Objectives

The Mathematics of Finance is designed to:

(1.) Meet one of the learning objectives of the VCCS (Virginia Community College System) standards for:

MTH 130:

Fundamentals of Reasoning

(Presents elementary concepts of algebra, linear graphing, financial literacy, descriptive

statistics, and measurement & geometry. ).

MTH 154:

Quantitative Reasoning

(Presents topics in proportional reasoning, modeling, financial literacy and validity studies (logic

and set theory).).

MTH

165: Finite Math

(Presents topics in systems of equations, matrices, linear programming, mathematics of finance,

counting theory, probability, and Markov Chains.).

(2.) Meet the QM (Quality Matters) and USDOE (United States Department of Education) requirements for

distance education as regards the provision of RSI (Regular and Substantive Interaction).

Federal Register: Distance Education and Innovation

St. John's University: New Federal Requirements for Distance Education: Regular and

Substantive Interaction (RSI)

Student – Content Interaction: Very high

Student – Student Interaction: High

Student – Faculty Interaction: High

(3.) Solve finance problems using technology: Texas Instruments (TI) calculators.

(4.) Solve finance problems using spreadsheets: Microsoft Excel and/or Google spreadsheets.

Skills Measured/Acquired

(1.) Use of prior knowledge

(2.) Critical Thinking

(3.) Interdisciplinary connections/applications

(4.) Technology

(5.) Active participation through direct questioning

(6.) Research

Symbols and Meanings

- $Per\:\:annum$ OR $Per\:\:year$ OR $Annually$ OR $Yearly$ means for a year (per $1$ year)

- $SI$ OR $I$ = Simple Interest or Dividend or Yield or Return ($)

- $P$ = Principal or Present Value or Investment ($)

- $r$ = Rate or Annual Interest Rate or Annual Percentage Rate (%)

- $APR$ = Rate or Annual Percentage Rate (%)

- $t$ = Time $(years)$

- $A$ = Amount or Future Value ($)

- $CI$ OR $I$ = Compound Interest or Yield or Dividend or Return($)

- $m$ = Number of Compounding Periods Per Year

- $n$ = Total Number of Compounding Periods $(years)$

- $CCI$ = Continuous Compound Interest or Yield or Dividend or Return($)

- $APY$ = Annual Percentage Yield or Effective Interest Rate or True Interest Rate (%)

- $FV$ = Future Value ($)

- $PMT$ = periodic payment ($)

- $PMTs$ = total periodic payments ($)

- $PV$ = Present Value of all payments ($)

- $payoff$ = payoff amount for a mortgage

- $k$ = number of remaining payments

- $CFV$ = Combined Future Value ($)

Formulas

Simple Interest

$ (1.)\:\: SI = Prt \\[3ex] (2.)\:\: SI = A - P \\[3ex] (3.)\:\: P = \dfrac{SI}{rt} \\[5ex] (4.)\:\: t = \dfrac{SI}{Pr} \\[5ex] (5.)\:\: r = \dfrac{SI}{Pt} \\[5ex] (6.)\:\: A = P + SI \\[3ex] (7.)\:\: A = P(1 + rt) \\[3ex] (8.)\:\: P = \dfrac{A}{1 + rt} \\[5ex] (9.)\:\: t = \dfrac{A - P}{Pr} \\[5ex] (10.)\:\: r = \dfrac{A - P}{Pt} \\[5ex] (11.)\:\: SI = \dfrac{Art}{1 + rt} $

Compound Interest

$ (1.)\:\: A = P\left(1 + \dfrac{r}{m}\right)^{mt} \\[7ex] (2.)\:\: P = \dfrac{A}{\left(1 + \dfrac{r}{m}\right)^{mt}} \\[10ex] (3.)\:\: r = m\left[\left(\dfrac{A}{P}\right)^{\dfrac{1}{mt}} - 1\right] \\[10ex] (4.)\:\: r = m\left(10^{\dfrac{\log\left(\dfrac{A}{P}\right)}{mt}} - 1\right) \\[10ex] (5.)\:\: t = \dfrac{\log\left(\dfrac{A}{P}\right)}{m\log\left(1 + \dfrac{r}{m}\right)} \\[7ex] (6.)\:\: A = P + CI \\[3ex] (7.)\:\: CI = A - P $

Values of m

| If Compounded: | m = |

|---|---|

| Annually |

1 (1 time per year) Also means every twelve months |

| Semiannually |

2 (2 times per year) Also means every six months |

| Quarterly |

4 (4 times per year) Also means every three months |

| Monthly |

12 (12 times per year) Also means every month |

| Weekly | 52 (52 times per year) |

| Daily (Ordinary/Banker's Rule) | 360 (360 times per year) |

| Daily (Exact) | 365 (365 times per year) |

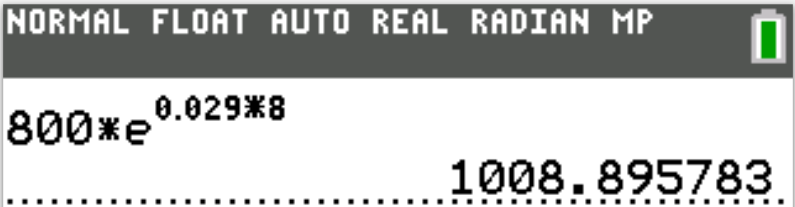

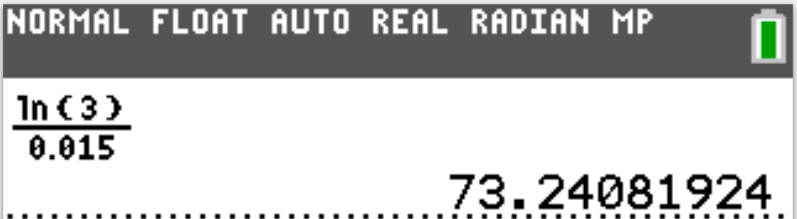

Continuous Compound Interest

$ (1.)\:\: A = Pe^{rt} \\[4ex] (2.)\:\: P = \dfrac{A}{e^{rt}} \\[7ex] (3.)\:\: t = \dfrac{\ln \left(\dfrac{A}{P}\right)}{r} \\[7ex] (4.)\:\: r = \dfrac{\ln \left(\dfrac{A}{P}\right)}{t} \\[7ex] (5.)\:\: A = P + CCI \\[3ex] (6.)\:\: CCI = A - P \\[3ex] $

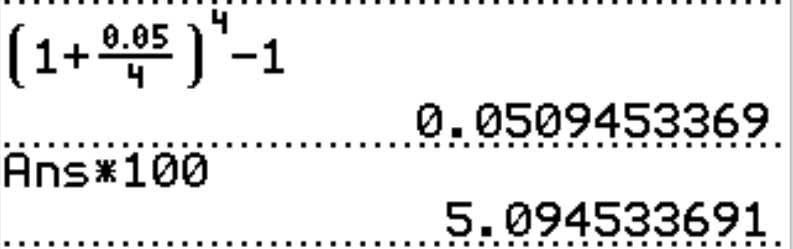

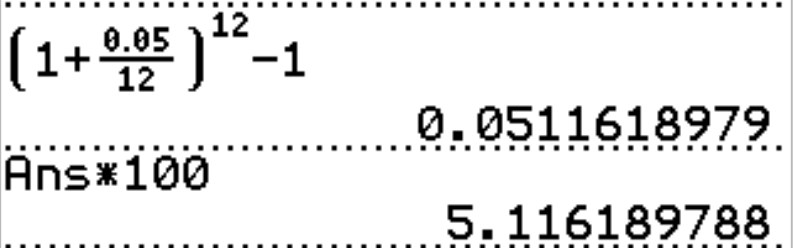

APY for Compound Interest

$ (1.)\:\: APY = \left(1 + \dfrac{r}{m}\right)^m - 1 \\[7ex] (2.)\:\: r = m\left[(APY + 1)^{\dfrac{1}{m}} - 1\right] \\[7ex] (3.)\:\: r = m\left(\sqrt[m]{APY + 1} - 1\right) $

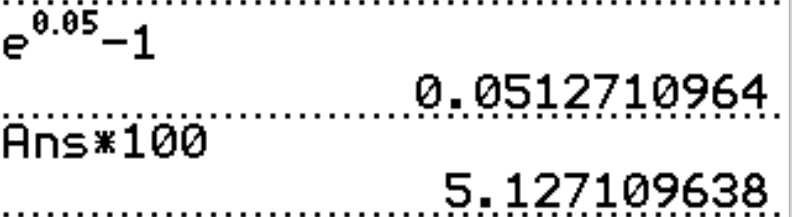

APY for Continuous Compound Interest

$ (1.)\:\: APY = e^r - 1 \\[4ex] (2.)\:\: r = \ln(APY + 1) $

Future Value of Ordinary Annuity

$ (1.)\:\: FV = m * PMT * \left[\dfrac{\left(1 + \dfrac{r}{m}\right)^{mt} - 1}{r}\right] \\[10ex] (2.)\;\; FV = PMT * \dfrac{\left[\left(1 + \dfrac{r}{m}\right)^{mt} - 1\right]}{\dfrac{r}{m}} \\[10ex] (3.)\:\: t = \dfrac{\log\left[\dfrac{r * FV}{m * PMT} + 1\right]}{m * \log\left(1 + \dfrac{r}{m}\right)} \\[10ex] (4.)\:\: Total\:\:PMTs = PMT * m * t \\[3ex] (5.)\:\: CI = FV - Total\:\:PMTs \\[5ex] (6.)\:\: n = mt $

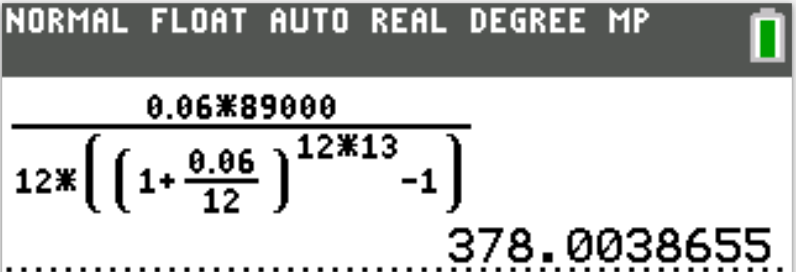

Sinking Fund

$ (1.)\:\: PMT = \dfrac{r * FV}{m * \left[\left(1 + \dfrac{r}{m}\right)^{mt} - 1\right]} \\[10ex] (2.)\:\: t = \dfrac{\log\left[\dfrac{r * FV}{m * PMT} + 1\right]}{m * \log\left(1 + \dfrac{r}{m}\right)} \\[10ex] (3.)\:\: Total\:\:PMTs = PMT * m * t \\[3ex] (4.)\:\: CI = FV - Total\:\:PMTs \\[3ex] (5.)\:\: n = mt $

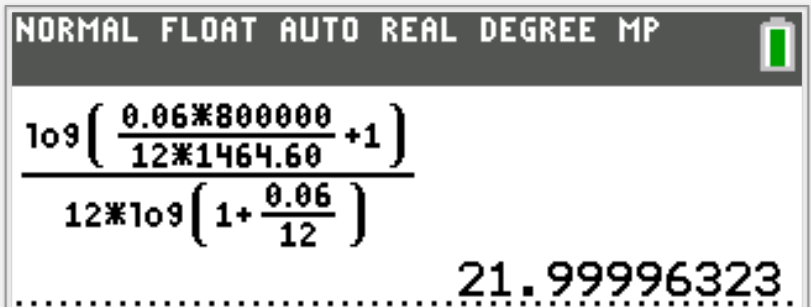

Present Value of Ordinary Annuity

$ (1.)\:\: PV = m * PMT * \left[\dfrac{1 - \left(1 + \dfrac{r}{m}\right)^{-mt}}{r}\right] \\[10ex] (2.)\:\: t = -\dfrac{\log\left[1 - \dfrac{r * PV}{m * PMT}\right]}{m * \log\left(1 + \dfrac{r}{m}\right)} \\[10ex] (3.)\:\: n = mt \\[3ex] (4.)\:\: Total\:\:PMTs = PMT * m * t \\[3ex] (5.)\:\: CI = Total\:\:PMTs - PV $

Amortization

$ (1.)\:\: PMT = \dfrac{PV}{m} * \left[\dfrac{r}{1 - \left(1 + \dfrac{r}{m}\right)^{-mt}}\right] \\[10ex] (2.)\:\: t = -\dfrac{\log\left[1 - \dfrac{r * PV}{m * PMT}\right]}{m * \log\left(1 + \dfrac{r}{m}\right)} \\[10ex] (3.)\:\: n = mt \\[3ex] (4.)\:\: Payoff = PMT * n * \left[\dfrac{1 - \left(1 + \dfrac{r}{n}\right)^{-k}}{r}\right] \\[10ex] (5.)\:\: Total\:\:PMTs = PMT * m * t \\[3ex] (6.)\:\: CI = Total\:\:PMTs - PV \\[3ex] (7.)\:\: CI = PMT * m * t - PV \\[3ex] (8.)\:\: Number\:\:of\:\:payments = m * t \\[3ex] (9.)\:\: Down\:\:Payment = Given\:\:Rate * Purchase\:\:Price \\[3ex] (10.)\:\: Amount\:\:of\:\:Mortgage = Purchase\:\:Price - Down\:\:Payment \\[3ex] (11.)\:\: Payment\:\:for\:\:x\:\:points\:\:at\:closing = x\:\:as\:\:\% * Amount\:\:of\:\:Mortgage $

Formulas (PDF)

These formulas accommodate the TI-83 and the TI-84 models that do not have the fraction format: n/d: $\dfrac{numerator}{denominator}$(Please see the formulas in red)

Compound Interest

Continuous Compound Interest

Annual Percentage Yield

Ordinary Annuity: Future Value and Sinking Fund

Ordinary Annuity: Present Value and Amortization

References

Chukwuemeka, S.D (2025, March 20). Samuel Chukwuemeka Tutorials: Math, Science, and Technology.

Retrieved from https://quantitativereasoning.appspot.com/MathematicsFinance/financialMathematics.html

TI Products | Calculators and Technology | Texas Instruments. (n.d.). Education.ti.com.

https://education.ti.com/en/products